A platform that protect users against risk is the platform best for users

https://twitter.com/ArchimedesFi

is best in protecting users by Protecting, broadening, and utilizing Liquidity pool investments.

Outline

Introduction to Archimedes

Archimedes Features

Archimedes Protected Single Pools

Tokenomics

Archimedes Updates

Official Links

Introduction to Archimedes

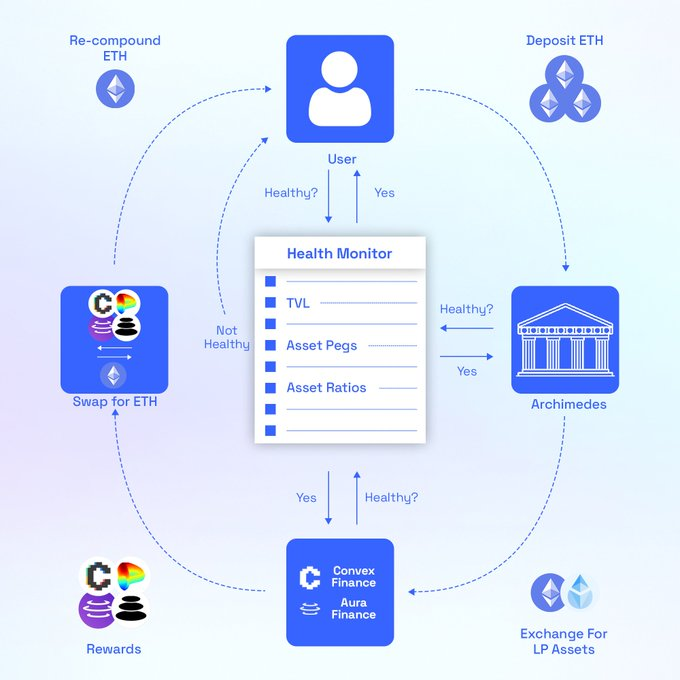

Addressing challenges such as 'Impermanent Loss' and the uncertain nature of reward tokens within your preferred liquidity pools, Archimedes V2 introduces strong solutions aimed at assisting users in their efforts to amass ETH, USDC, and/or BTC.

Archimedes Features

V2 stands out with 'Protected Single Pools' and 'Protected Omni-Pools' integrated with trusted yield aggregators like Convex and Aura (more to come). These pools are designed to enhance capital efficiency and mitigate liquidity risks.

Plus, users can access up to 5x leverage, making Archimedes V2 a DeFi platform focused on safety, accessibility, and efficient yield.

https://twitter.com/ArchimedesFi

Archimedes Protected Single Pools

Archimedes' Protected Single Pools (PSPs) streamline DeFi yield generation, offering an optimal solution for those seeking higher returns from assets like ETH, USDC, while mitigating typical liquidity pool risks.

Key features

include single asset deposits (e.g., ETH or USDC), strategic monitoring with real-time risk assessment, proactive risk mitigation through Offchain Monitor decisions, gas-efficient operations, and frequent reward compounding.

PSPs combine high-yield strategies with asset protection, shielding users from impermanent loss and security concerns.

With Archimedes, users can simplify their LP position, benefit from automated risk management, and enjoy more frequent compounding without gas expenses, all while their position is actively monitored.

-- Risk Reduction for single and multiple pools Archimedes' Protected Single and Omni-Pools are specifically crafted to reduce the typical risks faced by liquidity providers in Automated Market Maker Pools, including Impermanent Loss and Counterparty Risk.

When whitelisting pools, Archimedes guarantees that the liquidity is spread across a significant number of addresses, ensuring diversification.

-- Enhanced Capital Effectiveness

Holders of Liquidity Pools on protocols like Convex earn emissions in native tokens like $CVX and partner tokens like $CRV. To maximize yield, they need to manage these rewards through gas-intensive transactions.

Archimedes' Autocompounder solves this by enhancing Capital Efficiency. With Protected Pools, your compounding is gas-free; I’m

https://twitter.com/ArchimedesFi

handles the gas costs, and it automatically compounds your rewards, eliminating the need for timing decisions.

-- Unified Liquidity Hub

Archimedes serves as your liquidity central hub For users. Each pool listed in the app undergoes vetting by the underlying protocols (Curve/Convex, Balancer/Aura, etc.), along with Archimedes' assessment of Counterparty Risk.

Archimedes enhances your pool's liquidity through user deposits directly into the pool via Archimedes or by facilitating leverage positions within your pool For partners.

-- Sustainable Leverage

Sustainable leverage benefits all parties without token emissions. LPs and LTs earn returns with aligned incentives. LPs provide funds at lower risk for attractive yields, while LTs offer less collateral for higher leverage yields.

The protocol ensures LPs benefit from reduced risk, and neither LPs nor the protocol profit from LT losses, as long as positions remain healthy.

Tokenomics

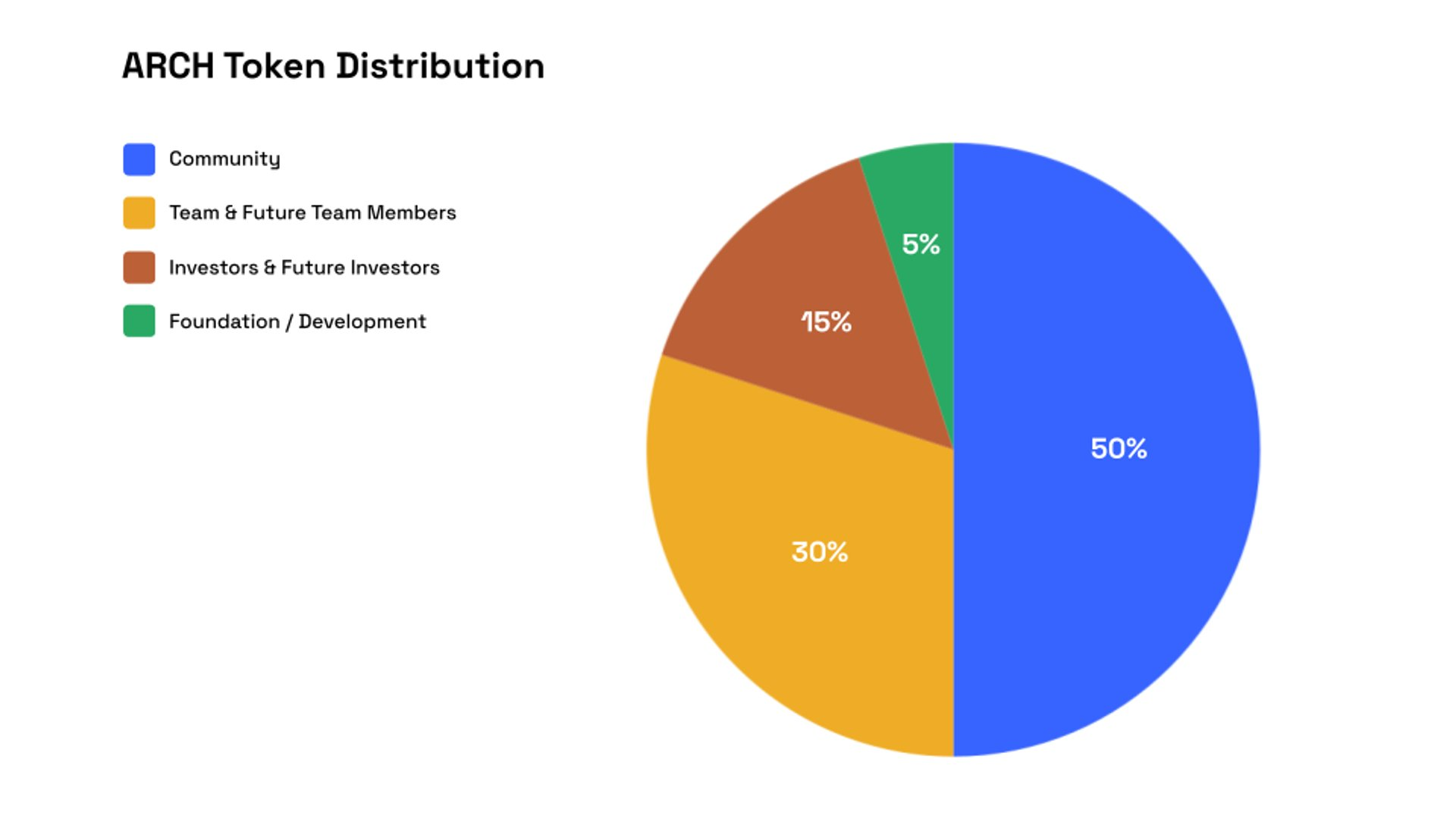

$ARCH is Archimedes’ Utility and Governance Token Ticker - ARCH

Max Supply - 100,000,000

ARCH Contract Address - 0x73C69d24ad28e2d43D03CBf35F79fE26EBDE1011

$ARCH token holders have the opportunity to stake their tokens in an 80/20 Balancer pool and receive $veARCH, which serves as the native governance and utility token for Archimedes Finance and Archimedes DAO.

-- Archimedes Updates

Archimedes currently have started phase 1 of their syracusia upgrade, and last week deployed the beta version of our Protected single pools

https://twitter.com/ArchimedesFi/status/1707092396821913800

right now Archimedes have the PSPs available, they’re working on the leverage on these pools as the next step, then have in their roadmap the omni-pools and the leverage for these omni-pools. Bullish right ?

Official Links Website: https://dapp.archimedesfi.com Twitter: https://x.com/archimedesfi?s=21… Docs: https://docs.archimedesfi.com/archive/archimedes-finance-whitepaper-(v2)… Roadmap:

Don't forget to follow

https://twitter.com/paulchristain__

Twitter Link;